County appraisers will be performing physical inspections of properties shown on the blue areas of the cycle map. Click "Learn More" to view the map Learn More >

In addition to online services, a secure processing drop box is available on the first floor of the Public Service Center.

Quick Links

Welcome to the Assessor's Office

Each year, the Assessor's Office identifies and determines the value of all taxable real and personal property in the county. These values are used to calculate and set levy rates for the various taxing districts (cities, schools, etc.) in the county and to equitably assign tax responsibilities among taxpayers.

We hope you find the information here helpful as you learn more about the Assessor, our office and the work we do in Clark County.

News Releases & Office Updates

- Assessor, Auditor, Treasurer close joint lobby to walk in customers through January

- Fire District 3 to be added to Battleground property tax statements

- 2021 Farm Advisory - 1/11/21 from 9 am - 11 am

![]() Follow the Assessor's Office on Nextdoor

Follow the Assessor's Office on Nextdoor

Through Clark County Communications

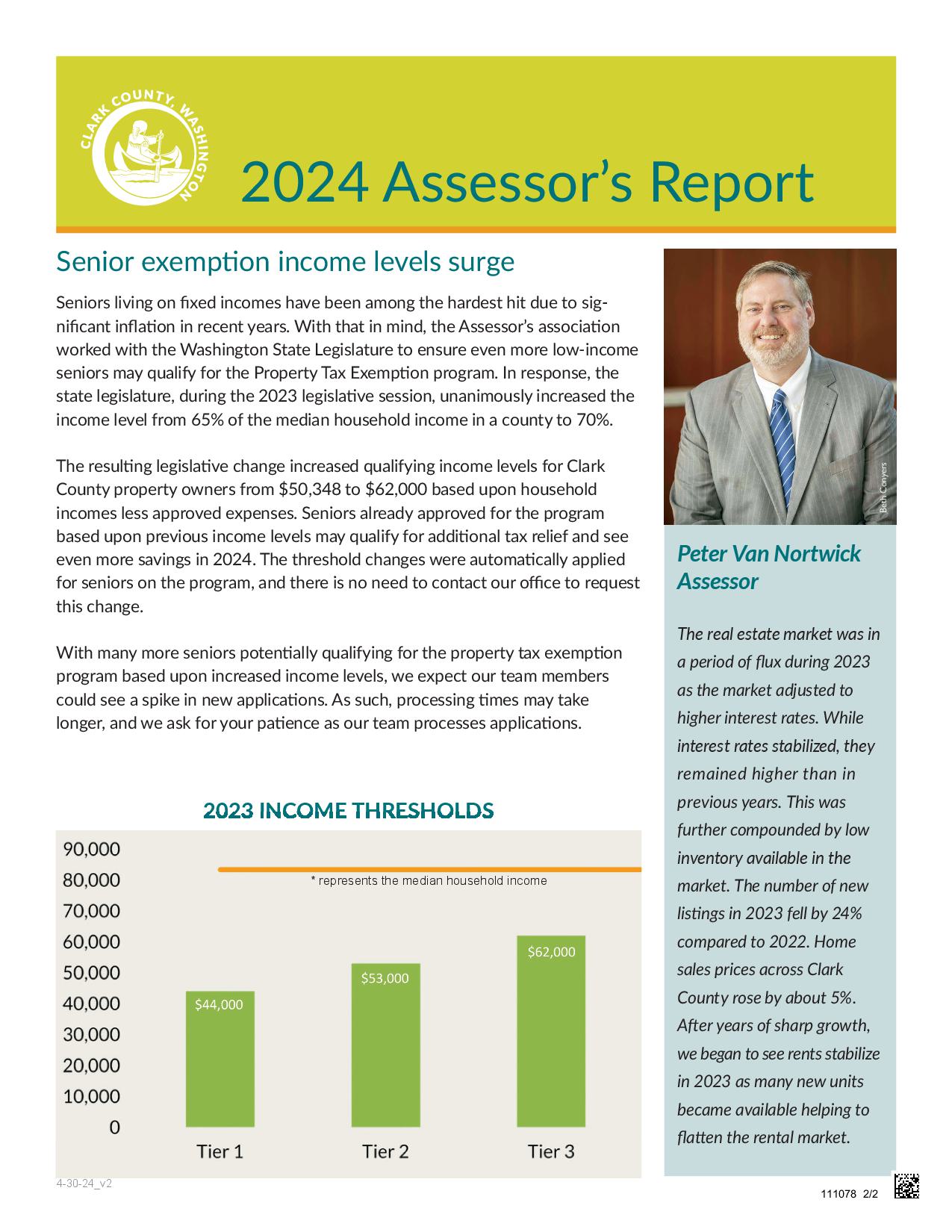

Seniors and Persons with Disabilities Property Tax Exemption

Income levels have increased for the Seniors and Persons with Disabilities Property Tax Exemption Program. Please visit the Tax Relief Programs web page for more information on qualifications and to print an application.

Find it Fast

Peter Van Nortwick, Assessor

The 1% Property Tax Limits

Frequently, our citizens ask, "I thought my property taxes could only increase 1%?" The 1% limit is often discussed in the media but not often explained. The 1% increase limit applies to the amount of property tax collected by tax districts. The 1% increase limit does not apply to individual property tax payers.

If a tax district was able to collect $100 in property taxes last year, the amount they may collect this year will increase to $101 plus an allowance for new construction. Typically, increases in your overall tax bill are driven by two factors:

1) voter-approved levies which are not subject to the 1% increase limit, and

2) an increase in your assessed value if the increase is larger than the typical increase in value.

Your property tax increase cannot be appealed. You may, however, appeal the assessed value established on your property within 60 days of the date on your Notice of Value if you believe the assessed value is greater than the market value of your property.

Property Valuations in Clark County

To help you understand what we do in the Assessor's Office and how that impacts your property valuation, we created a short video that follows some of our appraisers as they perform their jobs.